As a single Bitcoin will soon be worth $1,000, here’s why we should have invested in the crypto-currency two days ago, when it was trading at $850 area.

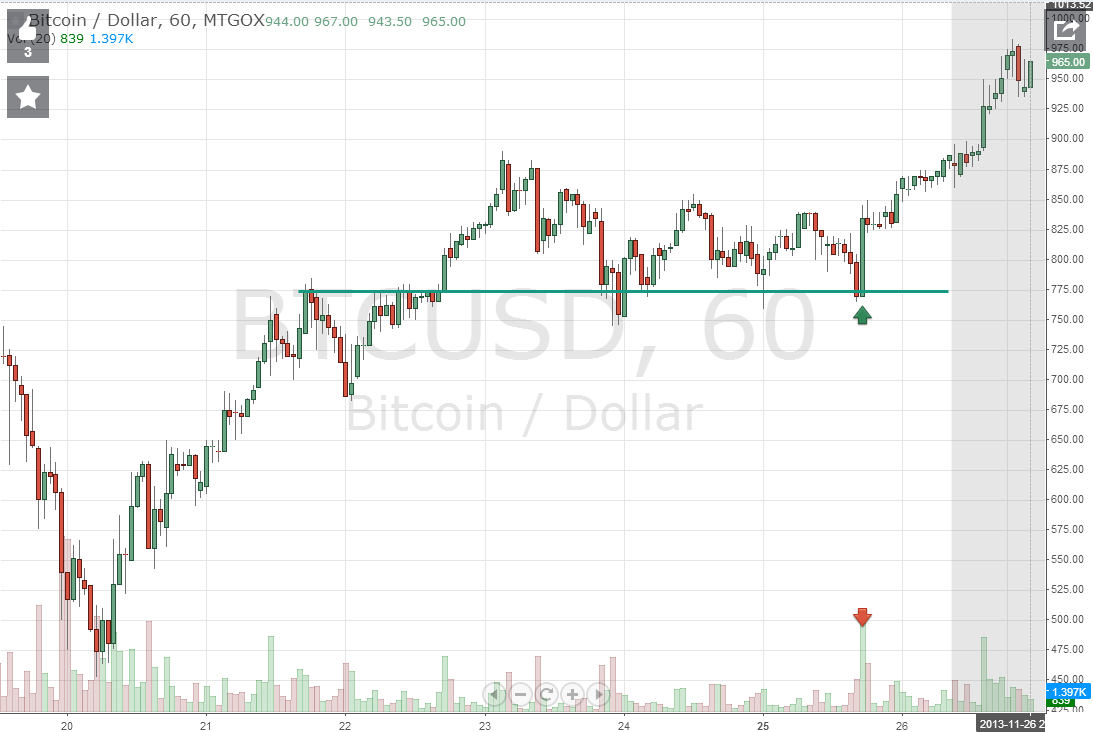

The support level at $775 was easy to draw.

- First, it was the resistance on 21 November.

- 3 days later, the resistance level had already been converted into support by the hammer candlestick followed by the bullish engulfing pattern.

- On Monday’s dawn the spinning top with the long wick confirmed the support level once again.

- And finally, the noted bullish candlestick formation verified the level for a third time, before Bitcoin climbed back up to the resistance level at $880.

I shared that chart at Google+ at that exact moment.

Traders had 5 hours to go long Bitcoin

Why was that last formation so important, apart from the fact it was completed exactly on the support level? Because of the volume spike, indicated at the bottom of the chart.

The full body candlestick, the support level and the volume spike showed enormous strength of buying power. That candlestick was printed on the hourly chart and Bitcoin continued trading close to the bar’s close for about 5 hours. We can see that from the 5 short-ranged candlesticks that followed.

Say we went long at $840, how would we manage the trade?

First things first. Stop loss. I would set a stop loss right at the bottom of that long green candlestick, at about $760. Thus, I would stand to lose $80 per Bitcoin traded.

Then comes the profit target. Given my prediction proved correct, I would be looking to exit half or 70% of my position at $880. Yes, that is a measly 1:2 risk/reward ratio. Still, if you believed you’d be correct more often than 66% of the time, you’d be making money in the long run by trading this way.

Of course, another option was to enter at $775 before the confirmation I’m talking about here. Since there was evidence that support would probably hold, buying at $775 and risking $50 would result to 2:1 R/R ratio if you exited at $875. In that case, your success rate should have been at least 33% to consider that a value trade, a trade with positive expected value in other words.

But let me return to my original trade.

I exited 70% of my position at $880. At the same time I moved my stop loss to breakeven point. I don’t stand to lose money in this trade. But where do I sell the remaining of my position?

Let’s move forward and see the Bitcoin chart at this moment.

If I sold at $960 right now, my 30% of my original position would accumulate $120 more. So, if I traded 10 Bitcoins from the start and made $280 by selling 7 of them at $880, my profit from the remaining 3 comes down to $360. Yes, one third of my position would have made more money! That’s the beauty of scaling out!

I could also use a trailing stop and maybe catch a bigger movement. In that case I would place a trailing stop at $925 and move it up, as Bitcoin tries to go beyond $1,000. Given I expect some resistance at that key round number, I may exit 20% of my initial position, and use a very loose trailing stop for the rest (10%).

Have you been trading Bitcoin since Bitcoin value increased above $500? Or have you been one of the early Bitcoin adopters when it was worth much less than that? Let me know in the comments below.

Charts: TradingView

Comments (No)