In breakout trading we are looking for breakouts that occur at key support or resistance levels. Yet, it’s not the breakout itself that is the decisive factor for initiating a trade. It is actually the significance of the penetrated level that matters the most.

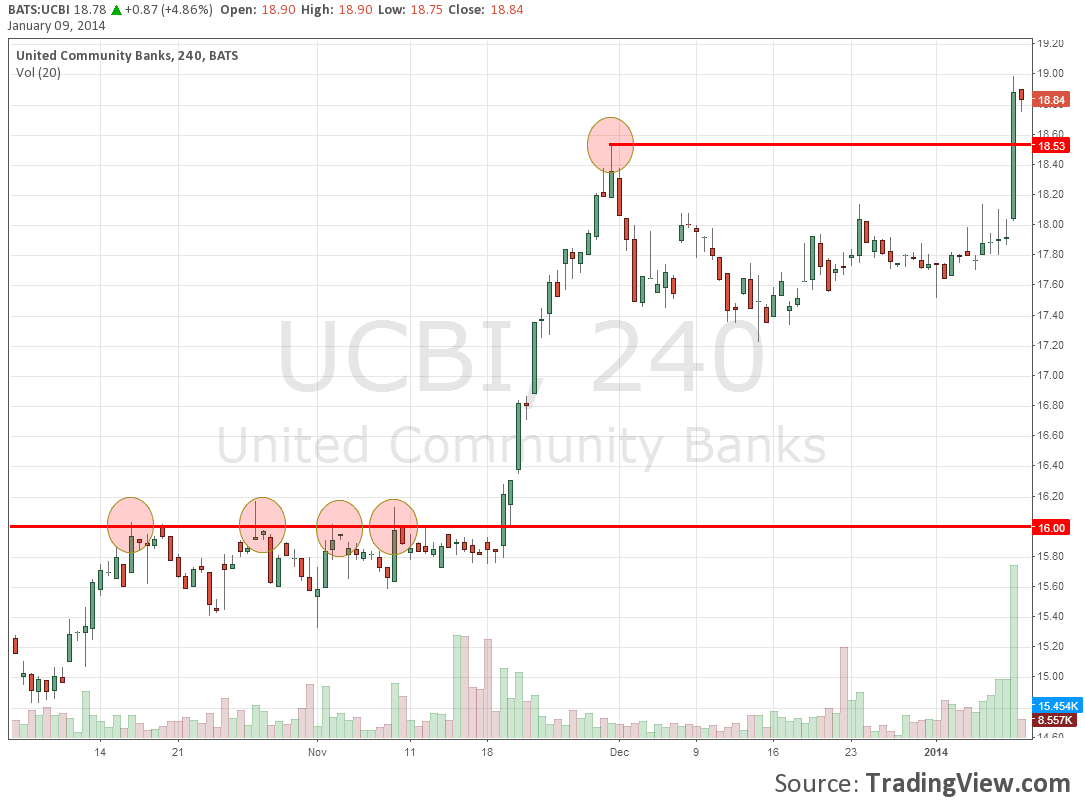

Scanning today’s action at Wall Street, I came across UCBI stock chart. To begin with, UCBI was featured in the unusual volume list of NASDAQ with a 250% change of its average volume. I usually scan this kind of stocks, as unusual volume may indicate the start of a new trend or the acceleration of an established one. If the volume spike is combined with intriguing price action, there’s money to be made – or lost!

UCBI stock was seemingly breaking out. But before I tell you about today’s breakout trading, I’ll go back and discuss the breakout that happened in November first. Be patient, it’ll make all the sense in the world shortly afterwards.

Breakout trading in favorable conditions

The resistance level was easily spotted at that time. $16 was a round number and round numbers make perfect support and resistance levels as you probably already heard. UCBI stock price met resistance at that level once, twice… five times in 2 months’ time! That surely makes it a respectful price level.

On 19 November UCBI shares climbed higher than $16.20. They did so by printing a promising bullish candlestick; simply put, that’s a long green candlestick with almost no wicks. Buyers had full control of the market during those 4 hours (did you notice it’s the 4-hour chart?). Yet, volume was about average.

Breakout trading meant at that point that we should have gone long at $16.20. A likely stop loss could have been $15.60 or $15.20, where we should have exited, in case the breakout failed – known as fake breakout.

10 days later the stock was up 12%. What is more impressive though is the fact that each day a new higher low was printed on the chart! Our trade would seem safer day after day.

This price action was due to the importance of the resistance level that had failed. During the consolidation phase between September and November, investors and buyers were getting ready for the move. The stock was picking up all that energy, yet it couldn’t breach that resistance level. Each time it failed, stock price retraced a bit and then tried again.

When it finally broke loose after 5 attempts, momentum kicked in and short sellers were getting punished.

So that is the story of that 2-month-old breakout. How can that help me today? Let’s drag the chart forward.

When breakout trading becomes a lot riskier

Today’s breakout seems solider, doesn’t it?

- 2.5x average volume;

- Bigger breakout candlestick’s range (low to high).

However, there’s something very important missing. Yes, it’s the fact that the resistance level has been confirmed only once!

Surely we have quite a few reasons to justify a long entry today if we want to exercise breakout trading. In comparison with the previous breakout though, there’s not enough evidence that the resistance level was being respected by the market before. And if the market (that’s me and you, buyers and sellers) didn’t think $18.50 was in fact a respectable level, why should the breakout be a respectful one?

Apart from that, in breakout trading there’s also the issue of setting a stop loss. Previously we were able to risk up to one dollar per share. And that was in the worst scenario. Now we have to risk the same amount in best case, by utilizing the low of the breakout’s candlestick.

Should we be more risk-averse traders, we will need to place the stop loss further below to $17.20! That will certainly affect the risk/reward of this trade; and that’s bad money management. Simply put, the stock needs to gain a lot more than before, in order to make the trade worthwhile.

Breakout trading strategy isn’t as easy as buying when a new high is printed on the chart. We have to take several other factors into account. In my opinion, the most significant one is how important the failing resistance level has been up to that point.

What do you think of today’s price action regarding UCBI stock? Is the breakout reliable enough to trade? Let me know in the comments below.

Comments (No)