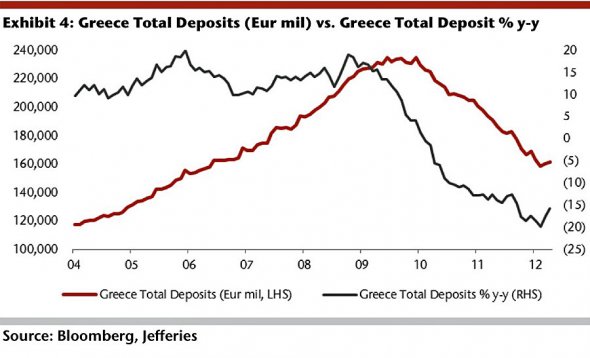

You must have already heard the news from Europe mentioning the plunge of bank deposits in Greece during June. About 7 billion euros have left Greece bringing the total household and corporate deposits in Greek banks down to 150B. The Greek bank run is expected to end though in July according to a report of a very popular Greek financial news portal. The report is in Greek and it discusses how the political stability and June’s election result have led many depositors to bring their money back to their bank accounts. The report has raised many doubts of its authenticity, despite the reporter stating that the statistics are coming from trustworthy sources.

If we are going to believe the report, July will be a record month for money returning to Greek banks. About 10 billion has been reinstated according to the news item! Compare that with the high of 1,45B that was put back in Greek banks in August 2011 and we’ll be certainly talking about a record if ECB confirms the figure in next month’s report.

It’s also interesting to take a look at the Greek bank deposits graph since 2004. Almost all finance websites are referring to the bank run since 2010, so it would be fair to also mention that June’s total deposits are well above the all-time low during the last 8 years. The Greek bank run has surely cost a lot of money for Greek banks, but it can cost even more. The situation is even worse for the banks, as they can’t depend on ECB for help since July 25th. ECB has announced that the European Central bank will no longer accept Greek government bonds as collateral, thus Greek banks need to turn to Greek emergency liquidity assistance (ELA). I suppose that 10 billion must have come on time, if the news is true!

Leaving the Europe news aside, bank deposits in US dollars over in China have been soaring the last few years. I suppose that information may come in handy regarding currency trading, as the US dollar has gained a lot compared to Euro since 2010. It sounds like Greeks get their Euros out of their banks and US dollars are increasingly deposited in Chinese bank accounts! Could there be a reversal of the EUR/USD downtrend? Perhaps Mario Draghi’s recent positive statements combined with an ending of the Greek bank run will put a floor in the market. We will know in one month’s time.

Comments (No)