People have always turned to the stock market for better returns and long term growth, but is it really better than other investments, such as real estate?

The answer is that the stock market is nothing more than a ‘higher frequency cyclical real estate market’ whereas the actual real estate market moves at a much slower cycle. Both are slowly rising over the years because of inflation, and both can be equally risky or rewarding to the unprepared investor. The stock market has always been a place for pension funds, they always wanted to invest a huge part of their reserves in long term, certain growth stocks. Today, many of the world’s private insurance firms, as well as state pension funds secure a huge portion of their clients pensions through stock market investments.

The stock market compares pretty favourable to many other forms of investing, namely the real estate and fine art markets. The reason is simple, when you invest in the high frequency cycle market you can easily apply cost averaging techniques, which means you can spread your capital over a period of partial purchases rather than a single purchase. As a result, the cost averaging technique allows pension funds and savvy investors to make money even when the market remains in an overall flat mode. Whereas a flat price mode in the real estate or fine art market will be catastrophic!

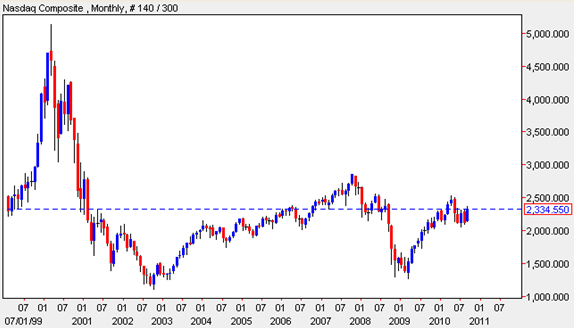

On this Nasdaq chart, one key leader of the US stock market, you can see how a cost averaging technique would have still made money after the tech bubble crash of the late 90s:

On the above chart, you could have bought stocks every year and picking both tops and bottoms, you could still make a decent return, but if the above chart was real estate value you would have to invest your money all at once. You could also invest in real estate every year but you would have to be really rich to afford such an investment… and then of course it’s capital gains tax, with the stock market it’s entirely possible to make millions and still pay nothing in taxes.

The stock market allows you to make money in any economy!

The savvy stock investor can easily invest in real estate, by proxy, just by investing in few real estate stocks, but he can also invest in few defence, or commodity stocks that will move higher even if the real estate market crashes! The real estate investor cannot diversify this much, unless he is willing to fly all over the world and be on the lookout for new opportunities. For example if Dubai real state falls today but Libya real estate is rising, and it makes sense to pull money out of Dubai and into Libya. But most real estate investors are focused on one country, and one market and are absolutely disadvantaged compared to stock market investors.

I have a web site where I give advise on penny stocks and stocks under five dollars. I have many years of experience with these type of stocks. If their is anyone that is interested in these type of stocks you can check ouy my web site by just clicking my name. I would like to comment. I do not think that we will see real improvement in the economy until we see sustainable job growth. Recently the number of jobs created has been running around two hundred thousand a month.The GDP report that just came out recently was only 2% this is not nearly high enough to sustain employment growth of two hundred thousand jobs a month Another factor holding things back is stagnation of wages and benifits. This is good for business owners but terrible news for workers.