There’s been quite a bit of news surrounding the Canadian dollar of late. Analysts are pointing to the drop in the value as an indication that the CAD is no longer the haven for the U.S. dollar that it has been for the last few years. The Canadian Central Bank however, views the drop as a positive development. They believe that the loonie has been much too strong of late and that the lower currency will be able to drive exports through lower prices on goods sold in the United States.

With so much discussion of the CAD, I thought it appropriate for me to show you what was happening to the USD/CAD today, Monday, January 27th.

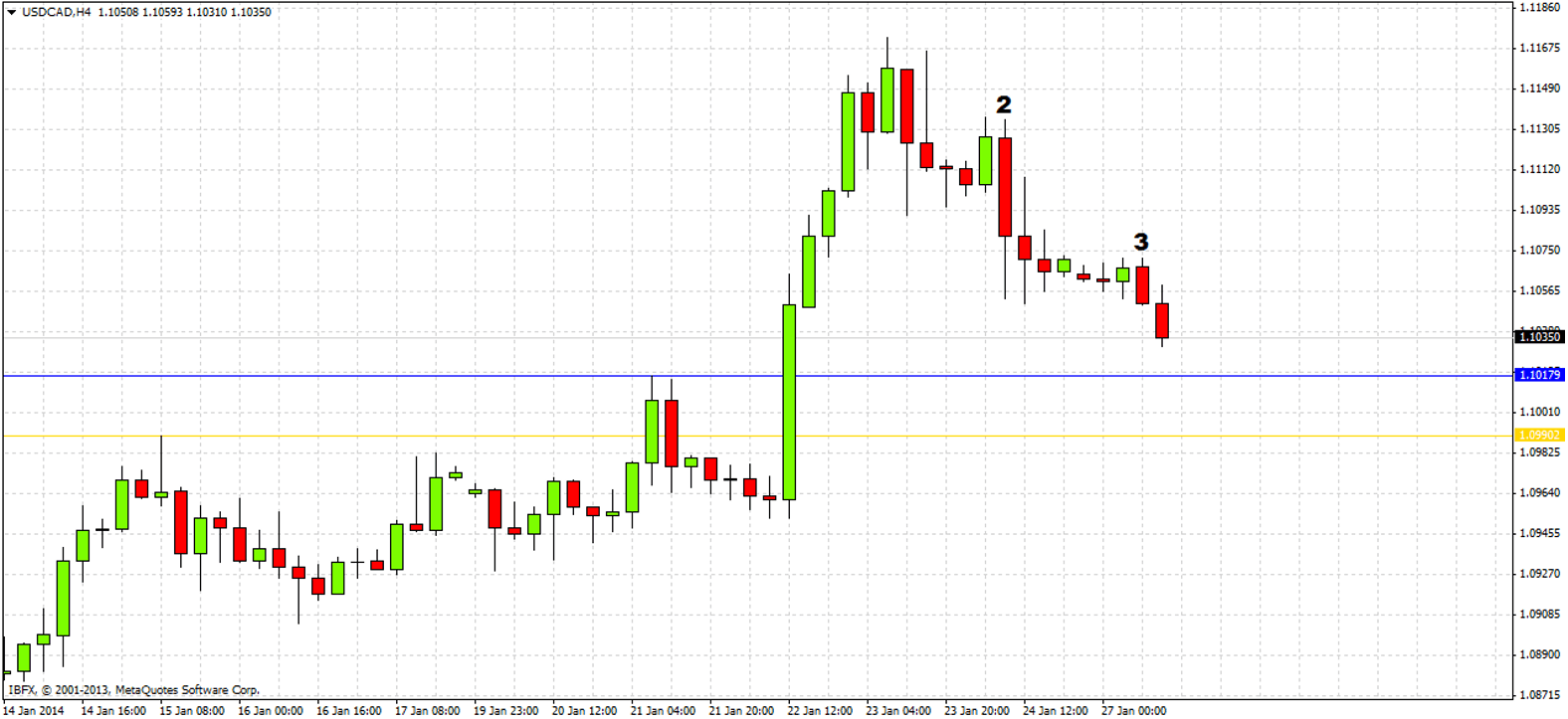

Here is today’s analysis of the USD/CAD pair:

We are picking up the trend in the middle of its activity and so in this pin bar chart you can see that the USD/CAD pair has been in a strong uptrend for quite a long time.

There seems to be no reason why a trader cannot trade pull backs in an uptrend. He/she just needs to manage trade exits differently when trading with trend or counter trend.

So here is how I read it: After reaching a high of 1.1173 last week, we are now in a pull back. If you look at the daily chart, chart #1, you will see a bearish pin bar that is then followed by a bearish engulfing bar which is marked at 1. This bearish sign is an indication that we are likely to move down to a support level before we might resume the bullish trend. The question is: what are the levels that are likely to provide turning points and will these turning points act as exits for any shorts or will they act as places to watch for long entries?

Bearish Reversal

Since we have a bearish reversal on the daily chart, we should then look for other daily or weekly highs on the chart as well as lows in order to reverse it. We find a daily high at 1.1018 which we can now flip over so it acts as support. We have marked it with a blue line on Chart 1.

Now look at the chart again and you will see that there is an even stronger likely support level below what we have marked. This is the weekly high from last week at 1.0990. This has been marked with the gold line in Chart 1. We can deduce that this is a very likely point at which there should be a bullish reversal, especially as this level is so close to the psychologically key round number of 1.1000.

Now let’s look at Chart 2 and see what we can find.

As we look at this current H4 chart, there is much indication that the currency pair will most likely first continue downward to at least 1.1018 before the price turns bullish, as the recent action on the H4 chart) shows bearish engulfing continuation candles, marked at 2 and 3.

[box type=”bio”] James Kosta is an 8 year experienced Stock trader who currently writes technical analysis for finance blogs. He currently lives in Richmond, London UK.[/box]

Comments (No)