Graphs of the banks’ stocks traded in the Greek stock market all show a decline with no support anywhere near. The banking sector of Athens Stock Exchange shows significant loss of value during the last months but even more worrying is the fact that there is no sign of a reversal either in monthly or daily charts. There are banks whose stocks have had several losing days in a row, while others retrace shallow before pushing their prices for lower lows. The low stock prices seem like a bargain for most banks, but economic news and bankruptcy rumors make buying stocks of Greek banks a risky trade.

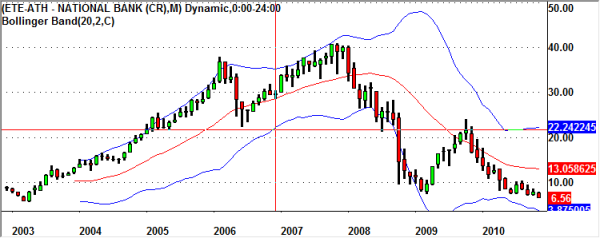

The stock with the most daily traded volume, ETE stock, is a fine example why we should not hold any shares of National Bank’s stock. The last support level at 7.46 has been broken in November and now the bank’s stock price is trading at €6.50. Next support might be met at 5.65 which was the support level in 2003 and the 8-year low price, but considering the financial condition of Greece and the numerous bad economic news and reports hitting the market every day, it will need very favorable stock news to turn the trend around.

The monthly stock chart of Piraeus Bank (TPEIR) shows about the same situation. This time the stock price is trading at the lowest price of last decade and the decline will most probably go below the €3.00 mark. The Fibonacci retracement to 38% indicated a strong downtrend which has now gone below the support level of 3.20. Most likely the next month’s candlestick will also be a red falling candlestick.

Other declining banking stocks include ATE stock, which has been trending downwards the last 8 or so years and TGEN stock, which did an 1-for-10 split a couple of months ago to avoid restricted trading in the Athens exchange. Geniki Bank’s stock was performing rather well up to 2006 when the uptrend reversal occurred and has continuously gone for lower stock price ever since. Additionally that stock moved 11% down yesterday while the volume increased, indicating that sellers still have the control of the market.

On the other hand, there are banks whose stocks try to resist the downtrend, such as Bank of Cyprus (BOC), Eurobank (EUROB) and Alpha Bank (ALPHA). Their stock prices are close to significant support levels and time will only tell whether they can avoid collapsing to lower lows. Finally, Bank of Greece (TELL) stock is also in the danger zone of a possible support level breakout. Should that happen it’s better not having that stock in our portfolio.

Hehe, firstly thanks for your continuous support! Really appreciate it!

Second I don't have ELBA any more since my stop loss was hit and exited with a loss.

Lastly I have not renewed my Esignal subscription so I don't have such a detailed access to Greek stock charts. Additionally I was quite disappointed by depth of market and liquidity comparing the Greek stock market to US. I'm now more focused to the New York Stock Exchange and I don't expect I will trade the Athens stock exchange any time soon.

If you got any suggestion for Esignal alternative, let me know.

I have been using Inforeks, Globalsoft Monopoly and Ztrade for the greek stock market. Can't say I am thrilled with the former two. I think ztrade has the most robust solution.

However, I tend to agree with you in that depth and liquidity here is sad, to say the least. Although there are some opportunities here based on fundamentals a fact that makes me think that most business owners here will either squeeze out their companies at these low valuations or they know that the market is going further down from here. 🙂

So you either pick a few "gems" (if there is such a thing) and hope for the first scenario or you just do what you are and trade more liquid markets.

Keep up the great work.