The most unhelpful clichés always begin with a heavy dose of nostalgia. The idea that what has been, gone and won’t return is a familiar phrase amongst financial veterans who see the glory days of financial speculation as a thing of the past. The days when computers didn’t exist, it took an hour to get a quote and trading was a thing that someone’s brother did. It is easy to see how the nicely inefficient markets tended to give rise to opportunities. These heydays have always existed in the minds of contemporary veterans, who often look back to around the 1980’s as evidence of a really good time and will be the first to point out that these opportunities have been blown away by the technological boom. These events they say, quite simply, would not occur in modern markets.

It is perhaps fair to say that much of what has been before, in terms of trading technique, may now be deemed redundant and superseded by software innovation. Old trading strategies may simply not work if they rely on the notion that it will take an hour to place an order. However, there are those which have definitively stood the test of time, adapted and even got better with age. One such technique is quite possibly the finest visual determinant of market sentiment ever invented. It has made countless traders incredibly wealthy, has higher reliability than modern electronic indicators, can be learnt and applied by anyone and is still incredibly successful today. Furthermore, to put it in perspective, its heyday was over three hundred years ago and it is still going strong. Candlestick analysis is, and will always be, a time-tested friend to even the most vociferous veteran.

We can safely say that the technique of candlestick analysis is very, very old. However, its beauty lies not only in its simplicity but also in its applicability to modern markets. Traders are having a good a time now using this technique as they were on the Dojima rice exchange in 1695. The individual candles on a candlestick chart represent a wealth of information from a snapshot in time. The open, close, high and low are a standard feature shared by both candlestick and bar charts but the visual impact of a candle is far greater. On their own candles can generate an insight into the future direction of price, they tell us when markets are over extended or gearing-up for a strong move. Applied together and candlestick charts become highly predictive and highly reliable. Just like the Japanese rice traders, anticipating the next move in price by looking for particular patterns gave them an edge which is still applicable today.

Of the forty or so candlestick patterns, the twelve majors can be boiled down to around seven or simply one if you want to master it perfectly. The doji, hammer and shooting star are both obvious on every chart and extremely reliable. Patterns such as ‘Dark cloud cover’ and ‘bearish/bullish engulfing’ are also among the most common, simple and profitable once you know exactly what you are looking for. Using these in conjunction with areas of known support and resistance and you will have, in my humble opinion, one of the most reliable trading strategies that money didn’t have to buy.

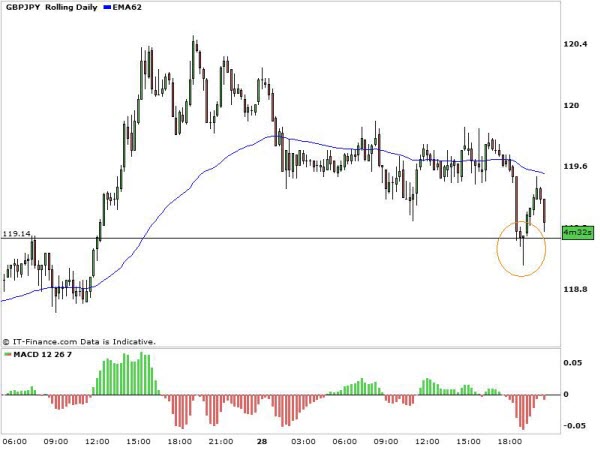

GPB/JPY Hammer on Support

Taking an example from this evening, to highlight the power of candlestick analysis, we can see from the 15 minute GBP/JPY chart that the obvious hammer candlestick marked in the red ring would have been a great signal to have taken a long trade for a short ride. Although they are often powerful enough to take signals on the appearance of a single candle the probability of a successful trade increases with the existence of a reinforcing element. In this case the horizontal line at the 119.14 mark was a level of historical support and resistance. During that 15 minute candle, price pushed through this but was beaten back by a large number of orders waiting for just this occasion. The result of this was the hammer candlestick. A signal as clear as this combined with an area of historical price-action is proof that candlestick analysis is not simply nostalgic nonsense but is absolutely here to stay.

Comments (No)