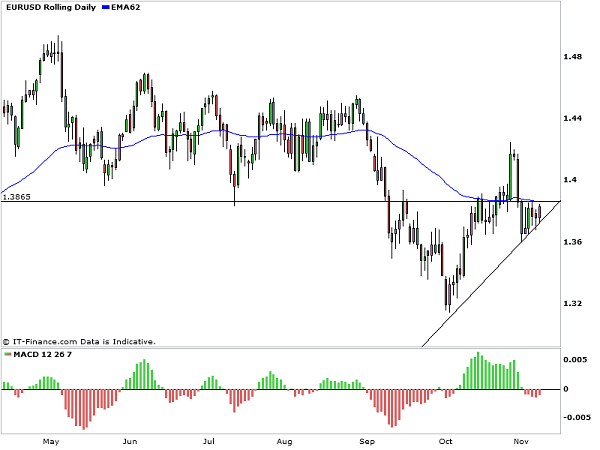

Despite the news that Berlusconi may survive after today’s vote of support the Euro held reasonably steady. The vote, which he won albeit by losing a large margin of power, was less of a referendum on the single currency but more of refection of the emotional state of a nation staring over the cliff. The fact that the Euro has remained essentially range-bound over the past few days is the anticipation of an event which will offer direction to the market. Much of the Greek crisis and the potential Italian situation appear to be factored into the EURUSD given today’s reaction. This has created an interesting wedge formation in the currency pair which is expected to break out over the next few days.

Wedges are formed when price begins to consolidate between upper and lower support and resistance lines. By consolidation it is meant that its range gets narrower forming a pressure point and often pushing against a flat resistance either above or below the price. This consolidation can be interpreted as a pause and, often, when it occurs at the top of a strong run in price range it can be considered to suggest that the market is perhaps looking to move lower. Despite this, during an uptrend, wedges can continue to make higher highs and higher lows. It is the narrowing range between these which indicates a wedge and a potential change in sentiment. These are known as a ‘rising wedge’, they still appear to be moving higher but they should be treated with caution if found after a strong trend.

The wedge formation on the 30-minute chart, as well as the small wedge pattern forming on the daily charts, points to a potential breakout to the upside. Having said this, these wedges can be notoriously unreliable and, given the precarious state of affairs in the European market, it could break either way dependent on news emerging over the coming days. Price has been making higher lows within this pattern and pushing against a flat resistance line above. It will potentially reach a point where the resistance will finally give in and send the Euro higher, most likely on positive news, or break lower as investors realise that it may be futile to push higher.

Trading wedges is perhaps more fruitful than attempting to second-guess the eventual direction of price within a symmetrical triangle pattern. Wedges give a far clearer indication of where price may go but are highly dependent on location. This element of subjectivity allows wedges to be interpreted differently dependent on where they exist on a price chart and what fundamentals are dominating the market. The most powerful reversal wedges can be seen to appear at the bottom and tops of large trends whilst continuation wedges can occur several times during a single trend. Trading these as entry signals can be highly effective. Placing orders outside of the wedge pattern in the direction of the anticipated move is a very simple and high-probability way to enter on the reversal or continuation of price. The probability that price will break and continue in the anticipated direction is higher with well-placed wedges and where indecision dominates the currency pair. The euro looks to be indecisive and the potential for a large movement increases the longer it maintains this pattern.

Comments (No)